I received the following email today, so decided to share this important property update news.

David Ashton

Australia’s rental market remains extremely tight, with vacancy rates and supply reducing further over the September 2022 quarter. As a result, rental prices nationally continued to climb.

While house and unit rents were unchanged, combined rents increased by 4.3% over the September 2022 quarter – the fastest quarterly pace of growth on record. Over the year, rents have increased by 10.3%, with the gap between house and unit rental rates now close to the largest on record.

New mortgage lending is trending lower and so too is lending to investors. In August 2022, new lending to investors was $8.9 billion, the lowest value since June 2021 and 23.9% below its recent peak. The share of overall lending to investors remains below its long-term average, as it has consistently since mid-2017, resulting in fewer investment properties being purchased and exacerbating supply challenges.

With fewer investors purchasing homes to rent out, the limited supply of stock coupled with strong demand are leading to the heightened increase in advertised rental rates.

Although, the growth and tightness in the rental market appears to be shifting from regional areas back to the major cities. This is being driven by the return of many people who fled the capitals during the pandemic, along with a sharp lift in overseas migration. This is especially the case in Sydney and Melbourne where supply has tightened significantly.

Finding an affordable rental is increasingly tricky due to high demand and low supply. Picture: Getty

The decline in lending to investors is likely to exacerbate existing supply challenges at a time when demand is picking up.

To ease these tight conditions, Australia’s rental market needs either reduced demand through more first-home buyer purchases or increased supply through more investor purchases.

Neither is likely to occur imminently and as a result, we expect rental rates will continue to climb.

Rental prices

Median weekly advertised rents increased by 4.3% over the September 2022 quarter to be 10.3% higher year-on-year, which is the strongest growth witnessed over the past seven years. As of the end of the quarter, median weekly rents were $480 nationally.

Combined capital city rents increased by 3.2% over the quarter to reach $485 per week, while rents in regional areas were unchanged at $450 per week. It’s a different story over the past year, with capital city rents up 7.8% and regional rents up 12.5%. However, it looks like the strength in rental growth has started to shift away from regional areas and back to the capital cities.

Capital city house rents rose 4% over the quarter and unit rents were 2.2% higher. In regional areas, house rents increased 2.2% over the quarter, while unit rents were unchanged.

The most notable trend over the quarter has been the strength of unit rental growth in Sydney and Melbourne, with advertised prices rising by 4% and 5% respectively.

Throughout the capital cities and rest-of-state areas, every market has recorded growth in excess of 5% over the past year, reflecting the limited supply of rentals and the ongoing strong demand.

The strongest rental growth over the past year was in Brisbane (14.1%) and regional Queensland (12.9%), while the smallest increases were in Hobart (6.4%) and regional Northern Territory (6.7%).

The deceleration in annual rental growth in most regional markets over recent months and acceleration in most capital cities highlights the shift in rental demand back to the city, as life returns to more normal post-Covid conditions and overseas migration ramps-up.

Rental yields

Although property prices have fallen over recent months, the increase in prices over the past year has typically been stronger than the increase in rents, which has forced gross rental yields lower. In September 2022, gross rental yields nationally were 3.8% compared to 4.1% a year earlier.

Gross rental yields have shifted only marginally in capital cities over the past year, from 3.8% in September 2021 to 3.7% in September 2022. Across the regional markets, yields declined from 5.2% to 4.5%.

The gross rental yield on a house fell to 3.5% in September 2022 from 3.9% a year earlier. Unit yields were unchanged at 4.2% and are currently edging higher from their recent lows.

The lowest gross rental yields in September 2022 were seen in Sydney (3.2%), Melbourne (3.5%), and regional Victoria (3.9%). The highest yields were found in regional Western Australia (6.8%), Darwin (6.2%), and regional South Australia (6%).

Mining and resource sector markets continue to have the highest rental returns, while Sydney and Melbourne and their surrounding locations overwhelmingly have the lowest rental yields in the country.

With property prices expected to fall and rental markets anticipated to remain tight, it’s likely that rental yields will rise over the coming year, as we’re already witnessing in unit markets.

New rental listings

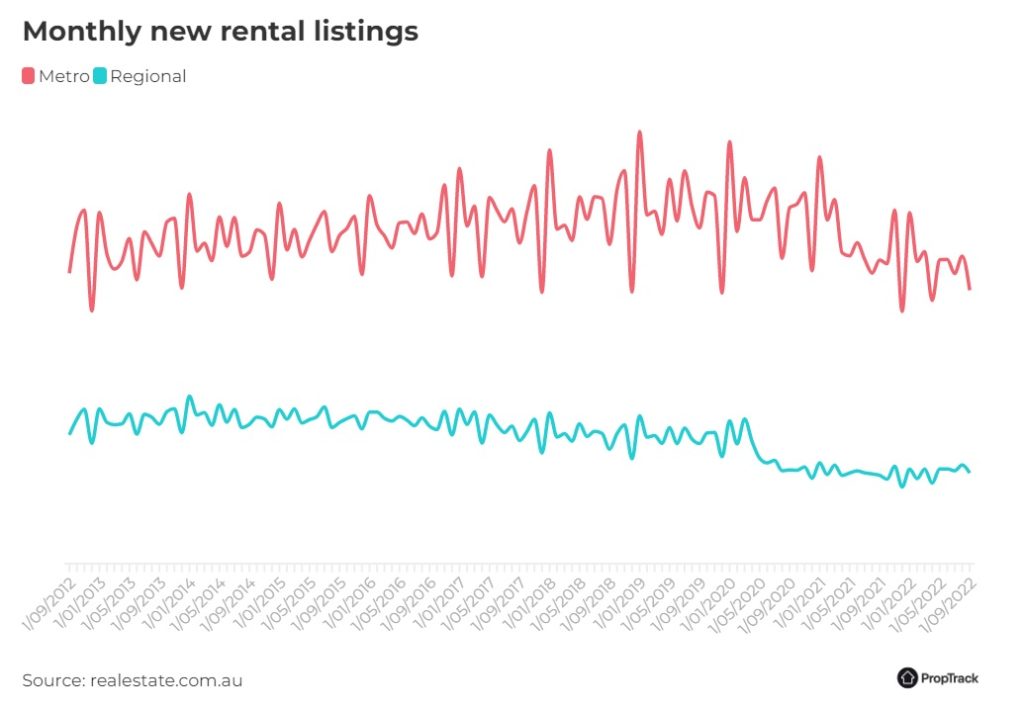

The number of new rental listings continued to trend lower in September 2022, with new listings down 10.4% month-on-month and 7.1% year-on-year.

For people seeking accommodation and hoping for an increase in rental stock, there are few signs of relief, with new rental listings 21% below the decade average in September 2022.

There is some divergence in new listing volumes between capital city and regional areas. New listings were 9.9% lower year-on-year in capital city areas and 18% lower than their decade average. New listings in regional areas were 2.6% higher year-on-year, although they were still 28.9% lower than the decade average.

New rental listings recorded the largest year-on-year increases in regional NT (39.3%), Canberra (35.5%), and Hobart (15.6%) in September 2022. The largest declines were in Melbourne (-13.9%), Brisbane (-12.6%), and regional WA (-12.5%).

The tightening of new listing volumes, particularly in capital city areas, highlights the rebounding demand for rentals in these markets and the ongoing lack of supply.

The number of new listings coming to the market remains insufficient to significantly increase supply and alleviate the escalation in rents. These conditions appear set to persist for some time.

Total rental listings

The total number of properties advertised for rent on realestate.com.au fell by 8% month-on-month in September 2022 to be 20.5% lower year-on-year. Rental listing volumes were the lowest they’ve been since mid-2003 and were 32.5% below their decade average.

Total rental listings in capital cities fell 8.6% over the month to be 25.2% lower year-on-year. This took them 27.9% below their decade average. Across regional markets, total rental listings fell 6.1% in September. They were only 0.1% lower year-on-year but remain well below (-44.3%) their decade average.

The largest capital cities have seen the biggest reductions in rental supply over the past year, with declines of 32.8% in Melbourne, 24.2% in Sydney, and 22.7% in Brisbane. The greatest increases in rental supply over the year were recorded in Canberra (30.2%), regional Tasmania (14.4%), and regional New South Wales (11.1%).

Over the past six months, we have seen the strength in the rental market shift from regional areas to capital cities as supply in major metropolitan areas tightens and rent prices climb. These trends look set to continue, with more renters arriving in capital cities, both from overseas and interstate. This comes as people return to cities after moving away over recent years, fewer people shift regionally, and more renters seek to become homeowners.

The tight rental supply looks set to persist, pushing the cost of renting higher and making it more difficult for tenants to find accommodation.

It should be noted that although rental price growth has been strong nationally, the cost of renting in Sydney and Melbourne has been largely unchanged since the start of the pandemic. This likely gives those markets some scope for significant rental increases as supply tightens and demand increases even further.

Rental days on site

Properties are leasing very quickly due to the elevated demand for rentals and the significant reduction in the supply of properties available for rent.

In September 2022, the median number of days a property was listed for rent on realestate.com.au was at an historic low of 19 days. This has been bouncing between 19 and 20 days for the past eight months and is lower than the 22 days recorded at the same time last year.

Rental days on site in September 2022 was at an historic low in Sydney and Perth. Sydney (-5 days) and Melbourne (-9 days) have seen the largest declines in rental days on site over the year, while Canberra (+5 days), regional SA (+4 days), and regional NT (+4 days) have recorded the largest increases.

Rental days on site is currently highest in Melbourne, regional Victoria, regional NT, and Canberra (all 22 days) and is lowest in Brisbane, Adelaide, and Perth (all 16 days).

With the supply of rental stock remaining extremely low and demand for rentals increasing as more people migrate to Australia, it seems that rental days on site will remain low and potentially fall further, particularly in Sydney and Melbourne.

With such a short period before rentals are leased on realestate.com.au, most properties that become available for rent are leased well before the property is vacant. These are ideal conditions for landlords but make it increasingly difficult for tenants seeking somewhere to live.

Rental vacancy rates

The national rental vacancy rate was recorded at 1.6% in September 2022, which was an historic low. The house rental vacancy rate sat at 1.1%, slightly above its historic low. The unit rental vacancy rate was 2.5%, a record-low.

Across the combined capital cities, rental vacancy rates were at 1.7% and have tightened up significantly over the past year. A year ago, the vacancy rate was 3.2%. Regional markets still have a tight rental vacancy rate at 1.3%. However, a year earlier they were 1.2% and had drifted lower before starting to climb over recent months.

Throughout the capital city and rest-of-state areas, rental vacancy rates were at historic lows in Sydney, Melbourne, Brisbane, and Perth. Rental vacancy rates were lower than a year ago in these four regions, along with regional Queensland, while they were higher year-on-year elsewhere.

The regions with the lowest rental vacancy rates in September 2022 were Adelaide, regional SA, Perth, and Hobart (all 0.9%). The highest rental vacancy rates were found in Melbourne (2.1%), Darwin (2%), and Sydney (1.9%).

Rental vacancy rates also indicate that the supply of rental stock is tightening in the major capital cities, reducing rental supply and vacancy. In regional areas rental markets undoubtedly remain very tight, with low vacancies. However, vacancies are now starting to ease a little regionally.

Potential renters

In September 2022, the number of potential renters nationally was 5.6% lower year-on-year and 22.5% below its peak. While overall rental demand may have eased somewhat, the reduction in rental supply has seen the number of potential renters per property listed on realestate.com.au increase by 18.8% over the past year.

The number of potential renters across regional areas of the country has fallen by 10.1% over the past year, while across the combined capital cities it is 4.5% lower. Despite fewer potential renters, the supply of rental stock has tightened much more significantly in capital cities. As a result, the number of potential renters per listing is 29% higher year-on year in capital city areas and 13.4% lower in regional areas. These trends highlight the strengthening of capital city rental markets and the easing of pressures broadly across regional areas.

Regional NT (-17.2%), regional WA (-16.7%), and Darwin (-14.6%) have seen the largest declines in potential renters over the past year, with the smallest falls recorded in Canberra (-0.2%), regional SA (-3.5%), and Melbourne (-3.6%).

Adjusting these figures against the supply of properties available for rent shows the largest increases over the year were in Melbourne (45.8%), Sydney (26.8%), and Brisbane (25.9%). Canberra (-33%), regional NT (-31%), and regional NSW (-21.7%) recorded the largest falls.

While overall demand for rentals may have eased from a year ago, it remains elevated. People are competing for a much smaller pool of stock, which is resulting in potential renters per listing generally being much higher. With demand for rentals increasing as more people migrate to the country and with no meaningful boost to rental supply expected, an improvement in availability of rentals for tenants still appears to be a way off.

Outlook

With a very tight rental market persisting and migration to Australia lifting, it appears that there will be no imminent easing of rental market pressures.

In saying that, we expect that some of the people who moved outside of the capital cities during the pandemic will return, with the impetus to move regionally also easing. Those who plan to stay regionally may now be committed to the area and potentially looking to purchase, which may ease rental pressures in these areas.

Our two biggest rental markets – Sydney and Melbourne – are seeing people that left during the pandemic return. In addition, most overseas migrants to Australia settle in these cities. These factors are likely to keep demand for rentals heightened, while supply of rentals is expected to continue to recede.

The solution to the current tight rental market is either more supply or less demand, or a combination of both. The share of lending to investors is trending lower and while there is some supply coming via build-to-rent, any additions are likely to be well and truly outweighed by the increase in demand from the re-opening of international borders and the ongoing decline in purchasing by first-home buyers.

These demand and supply issues can be addressed, but none of these factors appear set to change in the near term, which means a further tightening of rental supply and increases in rental costs seems likely.